Money Supply and its Determinants

Introduction

The supply of money is a stock at a particular point of time, though it conveys the idea of a flow over time. The term ‘the supply of money’ is synonymous with such terms as ‘money stock’, ‘stock of money’, ‘money supply’ and ‘quantity of money’.

The supply of money is a stock at a particular point of time, though it conveys the idea of a flow over time. The term ‘the supply of money’ is synonymous with such terms as ‘money stock’, ‘stock of money’, ‘money supply’ and ‘quantity of money’.

The supply of money at any moment is the total

amount of money in the economy. There are three alternative views

regarding the definition or measures of money supply.

·

The most common view is associated with the traditional

and Keynesian thinking which stresses the medium of exchange function

of money.

Forms of MS

M1 = C + DD (Demand Deposit)

M2= M1 +TD (Time

Deposit)

M3= M2 + Liabilities

of NBAFI

Determinant of MS

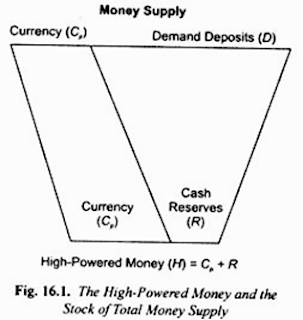

1. High powered Money (H= C + R), (M = C + D)

The H Theory of Money Supply’.

However, it is more popularly called ‘Money-multiplier Theory of Money Supply’

because it explains the determination of money supply as a certain multiple of

the high- powered money (M =m * H)

2. Money Multiplier:

·

Money

multiplier is the degree to which money

supply is expanded as a result of

the increase in high-powered money. Thus

·

m = M/H Rearranging

we have, M = H.m

·

Change in

the high-powered money is decided and controlled by central Bank, the money

multiplier determines the extent to which decision by central Bank regarding

the change in high-powered money will bring about change in the total money supply in the economy

·

m= Cr + 1

/Cr +rr(t +1)

From above it follows that money supply in

the economy is determined by the following:

o

H, that

is, the amount of high-powered money,

which is also called reserve money

o

r, that

is, cash reserve ratio of banks (i.

e., ratio of currency reserves to deposits of the banks)

o

This cash

reserve ratio of banks determines the magnitude of deposit multiplier.

o

k, that

is, currency-deposit ratio of the public.

3. Cash Reserve Ratio of the Banks and the

Deposit Multiplier (CRR)

Because of fractional

reserve system, with a small increase in cash reserves with the banks, they are

able to create a multiple increase in total demand deposits which are an

important part of money supply. The ratio of change in total deposits to a

change in reserves is called the deposit multiplier which depends on cash

reserve ratio (CRR increase MS decrease)

4. Currency-Deposit Ratio of the Public and Money Multiplier (Cr)

When as a result of

increase in cash reserves, banks start increasing demand deposits, the people

may also like to have some more currency with them as money balances. This

means during the process of creation of demand deposits by banks, some currency

is leaked out from the banks to the people.

Conclusion

·

Theory of

determination of money supply explains how a given supply of high-powered money

(which is also called monetary base or reserve money) leads to multiple

expansion in money supply through the working of money multiplier. We have seen

above how a small increase in reserves of currency with the banks leads to a

multiple expansion in demand deposits by the banks through the process of

deposit multiplier and thus causes growth of money supply in the economy.

·

The money

multiplier can be defined as increase in money supply for every rupee increase

in cash reserves (or high-powered money), drainage of currency having been

taken into account. Therefore, money multiplier is less than the deposit

multiplier.

·

It is

worth noting that rapid growth in money supply in India has been due to the

increase in high-powered money H, or what is also called Reserve Money (Lastly

Reserve Bank of India, the money multiplier remaining almost constant.

·

The money

supply in a country can be changed by Central Bank by undertaking open

market operations, changing minimum required currency reserve-deposit ratio,

and by varying the bank rate. The main source of growth in money supply in

India is creation of credit by central Bank for Government for financing its budget

deficit and thus creating high-powered money.

·

Further,

though the required currency reserve-deposit ratio of banks can be easily

varied by CB, the actual currency reserve-deposit ratio cannot be so easily

varied as reserves maintained by banks not only depend on minimum required cash

reserve ratio but also on their willingness to hold excess reserves.

·

Lastly, an

important noteworthy point is that though money multiplier does not show much

variation in the long run, it can change significantly in the short run causing

large variations in money supply. This unpredictable variation in money

multiplier in the short run affecting money supply in the economy prevents the

Central Bank of a country from controlling exactly and precisely the money

supply in the economy.

Comments