The Market Risk Framework

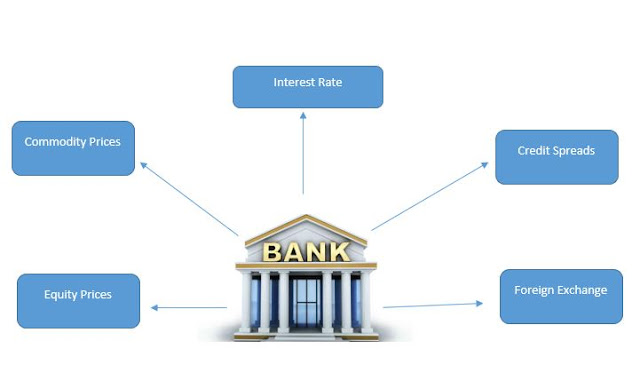

1. Introduction Market risk can be defined as the risk of losses in on-balance sheet and off-balance sheet positions arising from adverse movements in market prices. The major constituents of market risks are: a. The risks pertaining to interest rate related instruments; b. Foreign exchange risk (including gold positions) throughout the bank; and c. The risks pertaining to investment in equities and commodities. (Nepal Rastra Bank Unified Directives, 2019) Many banks have portfolios of traded instruments for short term profits. These por...