COVID-19 Impact on Foreign Exchange Reserves and Policy Response of Nepal

Before the global health crisis began, banks usually had a surplus foreign exchange on account of remittance which makes up more than 26 % of the GDP. They had extra funds which they sold to the central bank after fulling their market requirements. The central banks maintain foreign exchange based on the funds received from all banks and financial institutions. For instance if banks are not receiving sufficient foreign exchange reserves from tourism, export, and other factors of external sectors due to the decrease in the inflow of remittance. Then there will be low selling foreign exchange to the central bank by commercial banks. Since, Nepal is heavily dependent on the import of a number of essential goods such as food items, medicine, and petroleum products. With COVID-19 and recent lockdown across the globe, there is a rapid slowdown in foreign exchange into the nation. The inflow to go down further until the situation improves. As a result there will be a hard hit in the reserve of national accounts to meet the daily demand.

From the Americas Quarterly : An important lesson of the 2008–2009 financial crisis was that the emerging market economies with high levels of international reserves were better able to withstand the ripple effects of the global meltdown. In Latin America, the cases of Brazil and Mexico provide a clear illustration. When Lehman Brothers went under in September 2008, Brazil had foreign exchange (FX) reserves of $205.5 billion—equivalent to 12.9 percent of GDP—while Mexico had $83.6 billion, or 7 percent of GDP. While the FX reserve levels easily covered a year of short-term debt maturities, Mexico’s were below the other precautionary threshold of six months of import coverage. As above illustration, reserve management is key to process that ensures that adequate official public sector foreign assets are readily available to and controlled by the authorities for meeting a defined range of objectives for a country. Therefore, it must be managed properly during and after the current pandemic situation.

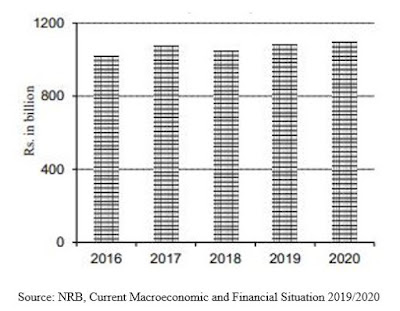

Analysis A: Nepal Gross Foreign Exchange Reserve (Mid-Feb)

From the Nepal Rastra Bank : Gross foreign exchange reserves increased 5.6 percent to Rs.1096.68 billion as at mid-February 2020 from Rs.1038.92 billion as at mid-July 2019. Of the total foreign exchange reserves, reserves held by NRB increased to Rs.947.24 billion as at mid-February 2020 from Rs.902.44 billion as at mid-July 2019. Reserves held by banks and financial institutions (except NRB) increased to Rs.149.44 billion as at mid-February 2020 from Rs.136.47 billion as at mid-July 2019. The share of Indian currency in total reserves stood at 22.9 percent as at mid-February 2020.

Analysis B: Foreign Exchange Reserve for Import Purpose

Foreign Exchange Reserve

From the Nepal Rastra Bank : Based on the imports of the seven months of the current fiscal year 2076/77, the foreign exchange reserves of the banking sector is sufficient to cover the prospective merchandise imports of 9.7 months, and merchandise and services imports of 8.5 months.

Analysis C: Remittance Inflow

|

From the above three quantitative analysis ,an adequate reserve of foreign exchange is essential to ensure that the country is able to import the desired goods and services from foreign countries. Remittance is the single large source of foreign exchange earnings for the country. In the last fiscal year, the country received remittance amounting to Rs 879 billion. (As shown in above figure). If the foreign exchange reserve starts to go down, we may have discourage import of luxury goods, cosmetics and high -end vehicles. Due to COVID-19, there is an alert signal that government may have to take following stringent measures if the foreign exchange reserve starts receding rapidly.

• Support and maintain confidence in the policies for monetary and exchange rate management including the capacity to intervene in support of the national currency.

• Limit external vulnerability by maintaining foreign currency liquidity to absorb shocks during times of crisis or when access to borrowing is curtailed and in doing so.

• Provide a level of confidence to markets that a country can meet its external obligations;

• Demonstrate the backing of domestic currency by external assets;

• Assist the government in meeting its foreign exchange needs and external debt obligations.

• Maintain a reserve for national disasters or emergencies.

• Sound reserve management practices are important because they can increase a country's or regions overall resilience to shocks. Through their interaction with financial markets, reserve managers gain access to valuable information that keeps policy makers informed of market developments and views on potential threats.

• Respond effectively to COVID-19 crises, which may have accentuated the severity of these crises. Moreover, weak or risky reserve management practices can also have significant financial and reputational costs.

In general, though, while lower FX reserves will insulate the Nepalese economy from the global economy and the consequence of COVID-19 this fiscal year 2076/77, at least they will give policymakers room to maneuver and help contain the pressure on external accounts and currencies as post-COVID-19 strategy. Therefore, sound reserve management policies and practices can support, but not substitute for, sound macroeconomic management. Moreover, inappropriate economic policies (fiscal, monetary, and exchange rate, and financial) can pose serious risks to the ability to manage reserves.

Comments