Harrod-Domar Growth Model - Nepalese Context

Nepal's economy is expected to grow by 5.5 percent in the

current fiscal year 2018-19 that began in mid-July, down from 5.9 percent in

the last fiscal.(ADB Report ,2018).In a report titled 'Nepal Macroeconomic

Update' unveiled by the Asian lender, it has pointed out the limited capacity

of provincial and local governments formed after last year's elections and

challenges to smooth implementation of federalism as the factors that could

pose risks to growth.

There are many least developing countries those who are facing

for problem in achieving a sustainable growth rate due to high vulnerability to

external shocks, human resource weakness criterion and Low-income criterion.

Among these three reasons, economic shock is most which is like a volatile

commodity price due to limited production and export as well as increasing food

prices due to their relatively low agricultural productivity.(Economic Growth

and Structural Change: Priorities for the Least Developed Countries, 2012)

Nepal has planned development experience development experience

of more than five decades. Still it is struggling for takeoff but incapable of

doing so. Nepalese economy is an underdevelopment economy having low supply

capacity and a number of structural bottlenecks: poor infrastructure , premature

financial infrastructure ,fiscal and trade deficits, foreign exchange

bottlenecks , market imperfection , weak supply capacity and basic goods

bottlenecks. (Nanda Kumar Dhakal, 2012). Besides that there two other main

reasons for the disappointing economic achievements. The first is unsuitable

economic policies based on political rather than economic consideration. And

second ,the implementation of economic policies and programs was limited by

weak administrative capacity and slack supervision.(Shanker Sharma ,1986)

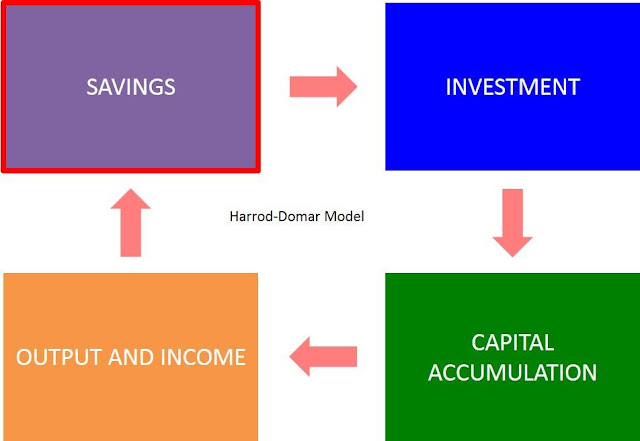

The Harrod-Domar Model :

The Harrod-Domar growth model gives some insights into the dynamics of growth. We want a method of determining an equilibrium growth rate g for the economy. Let Y be GDP and S be savings.The level of savings is a function of the level of GDP, say S = sY. The level of capital K needed to produce an output Y is given by the equation K=σY where σ designates the capital-output ratio K/Y. Investment is a very important variable for the economy because Investment has a dual role. Investment I represents an important component of the demand for the output of the economy as well as the increase in capital stock. Thus Investment I is DK = σDY.

For equilibrium there must be a balance between the supply of savings and the demand for increasing the capital stock. This balance reduces to I = S.

Thus, I = ΔK = σΔY

and I = S = sY

so

σΔY = sY.

Therefore the equilibrium rate of growth ΔY/Y which we call g, is given by:

ΔY/Y = s/σ = g

In other words, the equilibrium growth rate of output is equal to the ratio of the savings rate "s" and the capital-output ratio σ or K/Y. This is a very significant result. It tells us how the economy can grow so that growth in the capacity of the economy to produce is matched by the demand for the economy's output.Consider this numerical illustration. Suppose the economy is currently operating at a capacity production level of 1000 per year and has a capital-output ratio σ=K/Y=3. This means the capital stock is 3000. Assume the savings rate s=30% and the propensity to consume output Y is 70%. Savings rate "s" includes business and public savings as well as household savings.

The Harrod-Domar growth model tells that the equilibrium growth rate is g = 30%/3 = 10%; i.e., the economy can grow at 10% per year. We can now check this result with actual series of statistics.

Harrod- Domar model can be employed to forecast economic growth

rate on the basis of savings to national income proportion and capital output

ratio.The aggregate demand is growing rapidly with stagnant growth rate in

Nepal. It makes economy more vulnerable .Though remittance inflow in Nepal has

been growing healthily, a substantial increase in remittance income to control

the ballooning current account deficit , insignificant contribution in

investment and growth. It demands strong need of capital formation (Nepal

averaged 132847.72 NPR Million from 2000 until 2017) and rise in saving ratio (

3.8225 % in 2016) through flow of remittances in productive sectors.The growth

rate of capital market heavily based on financial sector and real sector ,

growing trade deficit and imbalance of the share of capital and labor source in

national income and stagflation are red flags to Nepalese economy . Although

the stock market development has significantly contributed to the economic

growth in Nepal for the period 1994- 2011(Jagadish Prasad Bist, 2017 ).

Concluding Remarks,

Harrod Domar Model is simple to understand and implement in development planning . According to Model, the growth rate of national income will be directly related to the saving ratio and inversely related to the economy's capital output ratio.That is , in order to grow economies must save and invest a certain proportion of their GDP. If you can reduce the household share of GDP then you can reduce the household consumption (C) share in GDP. By definition you are increasing the saving share in GDP. That's the trick for the sustainable growth. The main objective of the present blog is to observe saving and

investment/capital output ratio as determinants of economic growth of Nepal

with reference to Harrod-Domar model though this model is proposed for

developed countries. It is because relevance of Harrod-Domar model cannot be

undermined in the developing and underdeveloped countries like Nepal.

Comments