The Market Risk Framework

1.

Introduction

Market risk can be

defined as the risk of losses in on-balance sheet and off-balance sheet

positions arising from adverse movements in market prices. The major

constituents of market risks are:

a. The risks pertaining

to interest rate related instruments;

b. Foreign exchange risk

(including gold positions) throughout the bank; and

c. The risks pertaining

to investment in equities and commodities.

(Nepal Rastra Bank Unified Directives, 2019)

Many banks have

portfolios of traded instruments for short term profits. These portfolios

-referred to as trading books -are exposed to market risk, or the risk of

losses resulting from changes in the prices of instruments such as shares, bonds

and currencies. Banks are required to maintain a minimum amount of capital to

account for this risk.

(Basel Committee on Banking Supervision, 2005)

2.

The Main Driver of Market Risk

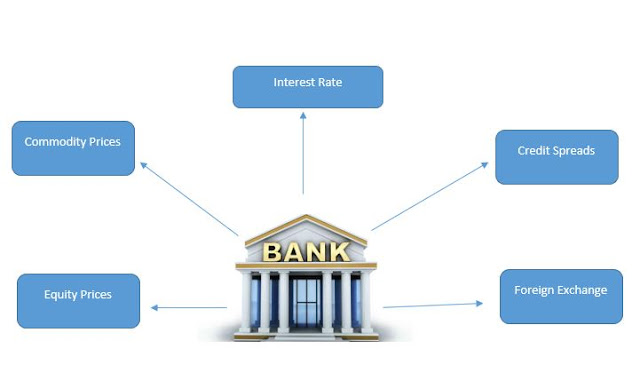

Fig:

Market Risk: The risk of losses arising from movements in market prices

The prescribed approach

for the computation of capital charge for market risk is very simple and thus

may not be directly aligned with the magnitude of risk. Likewise, the approach

only incorporates risks arising out of adverse movements in exchange rates

while ignoring other forms of risks like interest rate risk and equity risks.

Thus, banks should develop a framework that addresses these various forms of

risk and at the same time perform stress tests to evaluate the adequacy of

capital. The use of internal models by the bank for the measurement of market

risk is highly encouraged. Wherever bank's make use of internal models for

computation of capital charge for market risks, the bank management should

ensure the adequacy and completeness of the system regardless of the type and

level of complexity of the measurement system as the quality and reliability of

the measurement system is largely dependent on the quality of the data and

various assumptions used in the model.

3.

Approaches for Managing Market Risk

A. Net Open Position

Net open position is the

difference between the assets and the liability in a currency. In other words,

it is the uncovered volume of asset or liability which is exposed to the

changes in the exchange rates of currencies. For capital adequacy requirements

the net open position includes both net spot positions as well as net forward

positions. For capital adequacy purposes, banks should calculate their net open

position in the following manner:

·

Calculate the net open position in each of

the foreign currencies.

·

Convert the net open positions in each

currency to NPR as per prevalent exchange rates.

·

Aggregate the converted net open positions

of all currencies, without paying attention to long or short positions.

·

This aggregate shall be the net open

position of the bank.

Out of the various

components of market risk, foreign exchange risk is the predominant risk in our

country. The effects of other forms of market risk are minimal. Thus, a net

open position approach has been devised to measure the capital requirement for

market risk. As evidenced by its name, this approach only addresses the risk of

loss arising out of adverse movements in exchange rates. This approach will be

consolidated over time to incorporate other forms of market risks as they start

to gain prominence. The designated Net Open Position approach requires banks to

allocate a fixed proportion of capital in terms of its net open position. The

banks should allocate 5 percentage of their net open positions as capital

charge for market risk.

B. Computation of Risk Weight

Risk-weighted assets in

respect of market risk are determined by multiplying the capital charges by 10 (i.e.,

the reciprocal of the minimum capital ratio of 10%) and adding together

with the risk weighted exposures for credit risk.

i.

Internal Capital Adequacy Assessment

Process

The internal capital

adequacy assessment process (ICAAP) is a comprehensive process which requires

board and senior management oversight, monitoring, reporting and internal

control reviews at regular intervals to ensure the alignment of regulatory

capital requirement with the true risk profile of the bank and thus ensure

long-term safety and soundness of the bank. The key components are >

·

Board and senior management oversight

o

Bank management is responsible for

understanding the nature and level of risk being taken by the bank and how this

risk relates to adequate capital levels. It is also responsible for ensuring

that the formality and sophistication of the risk management processes is

commensurate with the complexity of its operations. A sound risk management

process, thus, is the foundation for an effective assessment of the adequacy of

a bank’s capital position.

·

Sound capital assessment

o

Policies and procedures designed to ensure

that the bank identifies, measures, and reports all material risk

o

A process that relates capital to the

level of risk

o

A process that states capital adequacy

goals with respect to risk, taking account of the bank’s strategic focus and

business plan

o

A process of internal control, reviews and

audit to ensure the integrity of the overall management process

·

Comprehensive assessment of risks

o

All material risks faced by the bank

should be addressed in the capital assessment process. Nepal Rastra Bank recognizes

that not all risks can be measured precisely. However, bank should develop a

process to estimate risks with reasonable certainties.

o

In order to make a comprehensive

assessment of risks, the process should, at minimum, address the different

forms of risk. They are credit risk, operation risk, market risk and

liquidity risk.

·

Monitoring

and reporting

The

bank should establish an adequate system for monitoring and reporting risk

exposures and assessing how the bank’s changing risk profile affects the need

for capital. The bank’s senior management or board of directors should, on a

regular basis, receive reports on the bank’s risk profile and capital needs.

·

Internal

control review

The bank’s internal

control structure is essential to a sound capital assessment process. Effective

control of the capital assessment process includes an independent review and,

where appropriate, the involvement of internal or external audits. The bank’s

board of directors has a responsibility to ensure that management establishes a

system for assessing the various risks, develops a system to relate risk to the

bank’s capital level, and establishes a method for monitoring compliance with

internal policies. The board should regularly verify whether its system of

internal controls is adequate to ensure well-ordered and prudent conduct of

business.

ii.

Supervisory

Review

Central Bank shall

regularly review the process by which a bank assesses its capital adequacy,

risk positions, resulting capital levels, and quality of capital held by a

bank. Supervisors shall also evaluate the degree to which a bank has in place a

sound internal process to assess capital adequacy. The emphasis of the review

should be on the quality of the bank’s risk management and controls and should

not result in supervisors functioning as bank management. The periodic review

can involve any or a combination of

·

On-site examinations or inspections

·

Off-site review

·

Discussions with bank management

·

Review of work done by external auditors

(provided it is adequately focused on the necessary capital issues)

·

Periodic reporting

iii.

Supervisory

Response

Central Bank expects

banks to operate above the minimum regulatory capital ratios. Wherever, NRB is

not convinced about the risk management practices and the control environment,

it has the authority to require banks to hold capital in excess of the minimum.

D. Disclosure

The purpose of disclosure

requirements is to complement the minimum capital requirements and the review

process by developing a set of disclosure requirements which will allow market

participants to assess key pieces 34 of information on the scope of

application, capital, risk exposures, risk assessment processes, and hence the

capital adequacy of the bank. It is believed that providing disclosures that

are based on a common framework is an effective means of informing the market

about a bank’s exposure to those risks and provides a consistent and

comprehensive disclosure framework that enhances comparability. The importance

of disclosure is more pronounced in cases of bank that rely on internal

methodologies in assessing capital requirements.

4. Conclusion

The instability associated

with the market dynamics draw the attention of banks upon the market risk management.

In the respect, banks improve and developed new methods in order to counter

these effects and also in order to better estimate interest rate risk, exchange

rate risk, and other types of risk. The effects generated by the external

shocks were a warning signal for the authorities to increase their capital as a

strong need for a correct covering of these risks.

5.

References

·

Milanova, E. (2010). Market risk management

in banks – models for analysis and assessment. FACTA

UNIVERSITATIS Series: Economics and

Organization, 7(4), 395-410.

Retrieved from http://facta.junis.ni.ac.rs/eao/eao201004/eao201004-04.pdf

(1) (PDF) Regulatory assessment of the bank market risk: International

approaches and Ukrainian practice.

·

Basel

Committee on Banking Supervision. (2005). Trading book survey: a summary of

responses. Retrieved August 10, 2013, from www.bis.org:

www.bis.org/publ/bcbs112.htm

·

Nepal Rastra Bank Unified Directives (2019).

Retrieved from https://www.nrb.org.np/contents/uploads/2019/12/Directives-Unified_Directives_2076-new-1.pdf

Comments