Monetary Policy in Developing Countries: The Way Forward

1.

Introduction

Monetary Policy is

concerned with the changes in the supply of money and credit. It refers to the

policy measures undertaken by the government or the central bank to influence

the availability,

cost and use of money and credit with the help of monetary techniques

to achieve specific objectives. Monetary policy aims at influencing the

economic activity in the economy mainly through two major variables i.e. (a) money

or credit supply and (b) the rate of interest.

According to A.J.

Shapiro, "Monetary Policy is the exercise of the central bank's control over the

money supply as an instrument for achieving their objectives of

economic policy."

Monetary Policy is not an

end in itself, but a means to an end. It involves the management of money and credit

for the furtherance of the general economic policy of the government to achieve

the predetermined objectives like Neutrality of money, price and exchange rate stability,

full employment and economic growth.

2.

Monetary Policy Influence in the Market

Monetary

policy influences economic activities in two ways:

i.

Directly

through Money Supply

Money Supply is directly

related to the level of economic activity. An increase in money supply

increases economic activity by enabling people to purchase more goods and

services and vice versa.

ii.

Indirectly

through Rate of interest

A change in money supply

influences economic activity through its impact on rate of interest and

investment. Increase in money supply reduces the rate of interest, which in

turn, increase in investment, and hence promotes economic activity, and vice

versa.

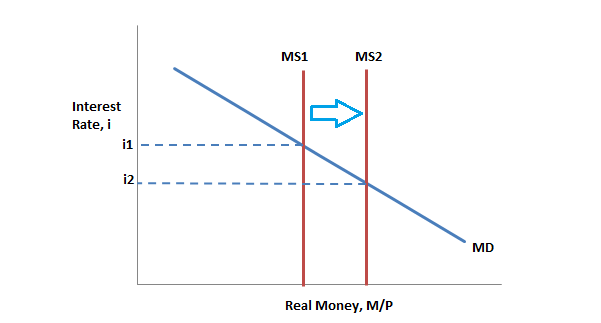

3. The Relationship between money supply and interest rate

Higher

money supply puts downward pressure on interest rates.

Lower

interest rates will also tend to reduce the value of the currency. If UK

interest rates fall relative to elsewhere, it becomes less attractive to save

money in UK banks. We will see an outflow of ‘hot money’ as investors move to

countries with higher interest rates. This will put downward pressure on the

currency as people sell Pounds to buy other currency.

There

is an inverse relationship between interest rate and money supply. Basically

banks increase money supply through credit creation. The liquid cash amount

usually remains more or less constant unless more money is printed through deficit

financing. But deficit finance if resorted beyond specific limit increases

inflationary pressure for which it is kept within tolerable limit by the Govt.To

regulate money supply through bank credit interest rate is used as a mechanism

by the Central Bank. If it wants to pursue a cheap money policy it reduces rate

of interest so that bank credit is expanded and money supply is increased

leading to expansion of economy through investment, if the Central Bank wants

to contain inflation it increases interest rate so that people are encouraged

to save instead of spending more money.

3. Limited Scope of Monetary Policy

in the underdeveloped countries

The

monetary policy has the limited scope in the underdeveloped countries because

of the following reasons.

·

There exists a large

non-monetized sector in most of the underdeveloped countries which act

as a great hurdle in the successful working of the monetary policy.

·

Small-sized and

unorganized money market and limited array of financial assets in underdeveloped countries also hinder the

effectiveness of monetary policy.

·

In most of the

underdeveloped countries, total money supply mainly consists of

currency in circulation and bank money forms a very small portion of it.

This limits the operation of central bank's monetary policy which basically

works through its impact on bank money.

·

The growth of nonbank

financial institutions also restricts the effective implementation of

monetary policy because these institutions fall outside the direct control of

the central bank.

·

In the

underdeveloped countries (e.g., in Libya), many commercial banks possess high

level of liquidity (i.e., funds in cash form). In these cases, the

changes in monetary policy cannot significantly influence the credit policies

of such banks.

·

Foreign based

commercial banks can easily neutralize the restrictive effects of

tight monetary policy because these banks can replenish their resources

by selling foreign assests and can also receive help from international capital

market.

·

The scope of monetary

policy is also limited by the structural and institutional realities of the

underdeveloped countries, weak linkage between interest rate, investment and

output, particularly due to structural supply rigidities. When investment is increased as a

result of a fall in the rate of interest, increased investment may not expand

output due to the structural supply constraints, such as inadequate management, lack of essential

intermediate products, bureaucratic rigidities, licensing restrictions, lack of

interdependence within industrial sector. Thus, higher investment, instead

of increasing output, may generate inflationary pressures by raising prices.

4. Conclusion

The Monetary Policy in an economy works through two main economic variables, i.e., money supply and the rate of interest. The efficient working of the monetary policy, however, requires the fulfillment of three basic conditions (a) The country must have highly organized, economically independent and efficiently functioning money and capital markets which enable the monetary authority to make changes in money supply and the rate of interest as and when needed. (b) Interest rates can be regulated both by administrative controls and by market forces so that consistency and uniformity exits in interest rates of different sectors of the economy. (c) There exists a direct link between interest rates, investment and output so that a reduction in the interest rate leads to an increase in investment and an expansion in output without any restriction. The developed countries largely satisfy all the necessary prerequisites for the efficient functioning of the monetary policy, whereas the developing or underdeveloped economies normally lack these requirements.

Comments